Frequently Asked Questions

To establish a company in Singapore, you will need to meet the following prerequisites:

- Company Name: Select a distinct name adhering to guidelines set by the Accounting and Corporate Regulatory Authority (ACRA).

- Shareholders: Have at least one shareholder, whether an individual or a corporate entity, regardless of nationality.

- Directors: Appoint a minimum of one director for your company, and this individual must be a resident of Singapore, aged 18 or above, and free from any legal disqualifications. The appointed director can be either a Singapore citizen, Singapore permanent resident, EntrePass or employment pass holder. Foreigners are also allowed to serve as additional directors alongside the local director.

- Company Secretary: Appoint a company secretary within six months of incorporation, who should be a Singapore resident.

- Paid-Up Capital: Determine the paid-up capital (minimum is SGD 1) at inception.

- Registered Address: Provide a local Singapore address for your company's registration.

- Compliance: Ensure adherence to all relevant Singapore laws, encompassing tax and accounting standards.

Consider seeking professional guidance or using platforms like Swiftly to simplify the incorporation process and guarantee compliance with legal requisites.

The application is processed within 1 working day after we have received all documents and payment. Note: On rare occasions, the incorporation process may take between 14 days to 2 months if the application needs to be referred to another agency/ACRA for approval or review.

No, it’s not needed. All signing of documentation can be done digitally.

In Singapore, company incorporation aids in protecting a business owner's assets from legal and financial risks. Other values that are in line with Singapore can benefit from an incorporated company include:

a) Startup Tax Exemptions (75%) on the first $100,000 and (50%) on the next $100,000 net profit amounting to $125,000 Tax Exempted for the first 3 years.

b) Partial Tax Exemptions (75%) on first $10,000 and (50%) on next $190,000 of net profit amounting to $102,500 Tax Exempted (if startup tax exemption is not applicable)

c) Personal Assets of Directors or Shareholders will not be implicated.(Subject to the "system of lifting the corporate veil", Eg: Officer or Shareholders who committed fraud.)

Paid-up capital is the total amount of capital that has been funded by shareholders. In other words, it refers to the sum of money that a company has received from shareholders who have completely paid for their purchased shares. The minimum paid-up capital requirement for setting up a company in Singapore is S$1.00.

Generally, the minimum paid-up capital to incorporate a company is S$1.00. The paid-up capital can also be increased anytime later. However, a healthy paid-up capital means more liquidity for the business. There can be situations where the company will need to have a prescribed minimum paid-up capital.

For example:

a) The business of the company is in an industry where licenses are required.

b) Where the company requires to apply for a loan.

We recommend taking reference from the intended initial deposit amount. For example, if you are depositing $1000 during the initial bank account set up, you can indicate $1000 as the paid-up capital amount.

The issued share capital must be paid up immediately upon incorporation into the corporate bank accounts.

You can immediately start using the capital for your company’s expenses.

Foreigners are not allowed to set up the company by themselves, they must engage a registered filing agent (such as Swiftly) to set up your company

Simply fill up the incorporation form and make payment. It’s that simple. Our proprietary technology includes reputable and secure APIs such as Myinfo and Sumsub that can automatically extract vital personal information from you and populate the form for ultra-fast submission. Once the form is submitted, Swiftly is able to generate the legal documents within seconds for your E-Signing. Once the documents are E-Signed, we will proceed to incorporate the company on ACRA. Swiftly’s Technology is the fastest, most secure in the market.

There are no restrictions on the types of business activities in which a Singapore company can engage. Some business activities, such as running a travel agency, recruitment agency, financial services company, school or other special cases, require licences from an approving authority before you can commence business.

ACRA may randomly carry out a due diligence exercise, which may lead to a delay in the name approval process. In addition, the business activity could be subjected to control and regulation by other government authorities. Should you have a preferred date for the incorporation, we would recommend for the name reservation to be done earlier. Once the name is reserved, the process to incorporate a company is guaranteed.

We would usually recommend our clients to fix the Company’s FYE on the last day of the 11th month since incorporation to fully maximise the tax exemptions that new start-up companies are entitled to for the first 3 years. After the first 3 years, you can then choose to decide to change your FYE to any other FYE you prefer. If the tax exemption is not of interest to you, you are able to choose whichever FYE that best suits your company right off the bat.

Swiftly is here to streamline the process, offering comprehensive assistance at a fee of $1200 per applicant. Additionally, for companies desiring MOM Account setup, an extra charge of $200 applies.

Our tailored services include:

-

Pre-application Guidance:

- Navigate the intricacies of the EP application process.

- Gather essential information to ensure a smooth application.

-

MOM Disbursement Fee Coverage:

- Swiftly covers the Ministry of Manpower's (MOM) Disbursement Fee on your behalf.

-

Application Status Monitoring:

- We keep a vigilant eye on your EP application's status throughout the processing period.

-

Communication with MOM Officer:

- In case of queries or clarifications needed, we engage with the designated MOM officer on your behalf.

-

Supplementary Information Handling:

- Addressing any requests from MOM for additional information to support your application.

-

Appeal Management:

- Should your EP application face rejection, Swiftly takes charge of the appeal process.

-

Issuance Coordination:

- Seamless coordination for the issuance of the EP upon in-principle approval (IPA).

At Swiftly, we understand the significance of a hassle-free Employment Pass application. Trust us to navigate the complexities, ensuring a smooth and successful process for your team. Contact Swiftly today for unparalleled expertise in EP application assistance.

Annual General Meeting

Unless exempted, your company is required to hold an Annual General Meeting (AGM). AGMs ensure that stakeholders of your company are kept updated about the company’s financial position and direction. It also provides a platform for stakeholders and company officers to communicate with each other at least once a year.

Annual Return

Private companies must file their annual return within 7 months after the financial year-end. Filing your company’s Annual Return on time helps to ensure proper and timely disclosure to all stakeholders. All companies including inactive and dormant companies are required to file Annual Returns. As long as your company’s status is “live”, you are required to file the Annual Return even if IRAS has exempted your company from filing its income tax return.

Corporate Tax

Companies must file Form C/Form C-S by the 30th of November every year unless IRAS has exempted the Company from filing its income tax return.

No. Unless you have a letter of consent from the Ministry of Manpower, you are not allowed to take up directorship or start a business as this will differ from the initial intention of your stay in Singapore.

- Directors’ Particulars (Can be extracted via Myinfo/Sumsub)

- Shareholders’ Particulars (Can be extracted via Myinfo/Sumsub)

Here are some banks which offer startup-friendly corporate bank accounts for your consideration:

Kindly note that the bank account application needs to be initiated from your end as you will be the signatory of the bank account.

The bank will request a copy of the company’s business profile and constitution. They can be downloaded from your Swiftly account.

Read more: I have documents requiring the signature of the Company Secretary or Nominee Director.

CorpPass is the authorisation system for entities to manage digital service access of employees who need to perform corporate transactions.

You can proceed to register for a CorpPass Account 2 working days after the company is incorporated.

You may refer to the user guide

If there are documents requiring the signature of the Company Secretary or Nominee Director.

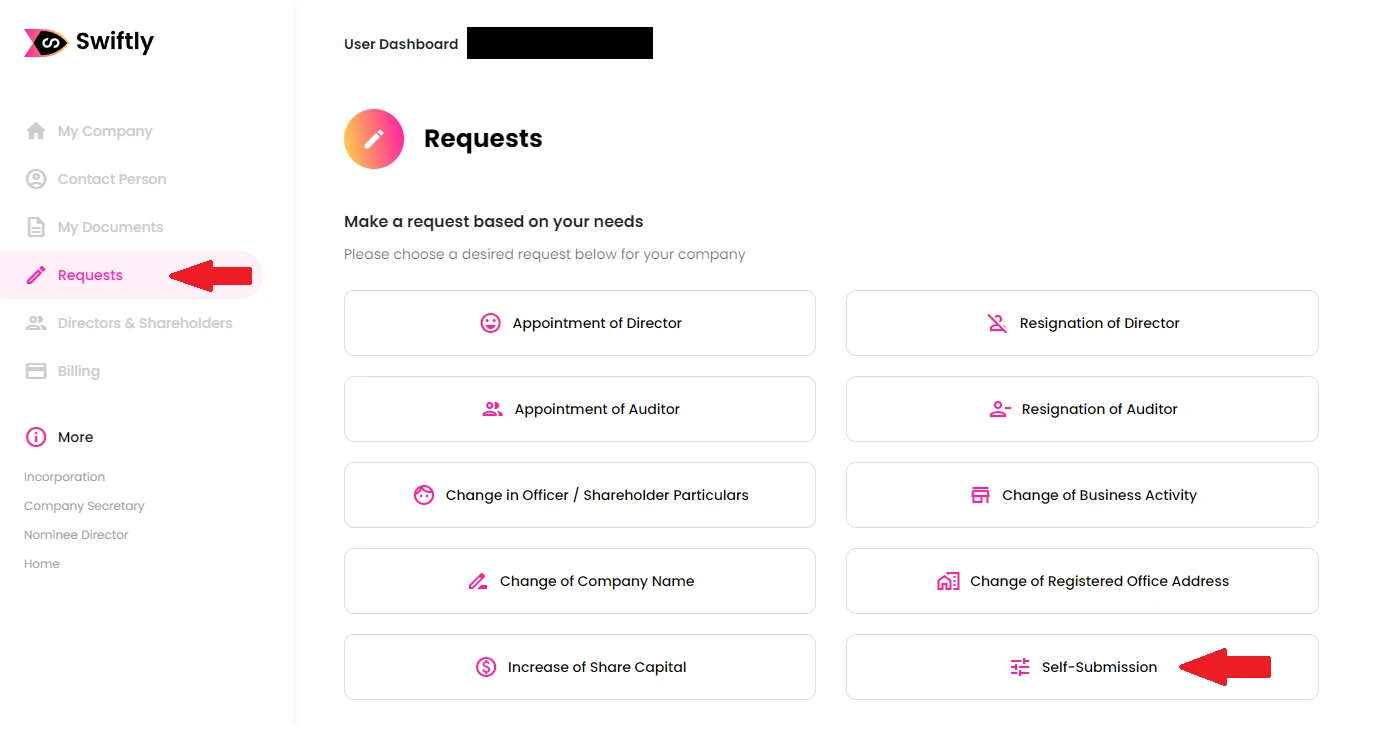

Kindly complete the form/document and arrange for any 1 director to sign on the document (if the director’s signature is required), then upload the signed document to your Swiftly portal under Requests > Self-Submission.

Refer to image below (Click to open in a new tab):

We will notify you once the document is ready!

The Register of Registrable Controllers (RORC) is a statutory requirement in Singapore under the Companies Act. It is a register that companies incorporated in Singapore must maintain to record information about their registrable controllers.

Registrable controllers refer to individuals or corporate entities that have significant control or influence over a company. They typically include individuals who own or control a significant number of shares, individuals who have significant influence or control over the company's management, and corporate entities that exercise significant control or influence.

The purpose of the Register of Registrable Controllers is to enhance transparency and ensure that information about the ultimate beneficial owners and controllers of companies is readily available to relevant authorities and law enforcement agencies. It helps prevent the misuse of corporate entities for illegal activities such as money laundering, tax evasion, or other illicit purposes.

Companies are required to identify their registrable controllers, obtain and maintain accurate information about them, and update the register whenever there are changes. The register is not publicly accessible but must be made available for inspection by specified persons, such as law enforcement agencies, regulatory authorities, and company officers.

By maintaining the Register of Registrable Controllers, companies fulfill their obligations to provide transparency and accountability regarding their ownership and control structure. It is an important tool in promoting corporate governance and combating financial crimes.

Beneficial Owner refers to a natural person (whether acting alone or together) who is either:

- an individual who ultimately owns or controls the company, whether directly or indirectly through a chain of ownership; or

- an individual whom the company perform transactions for or on behalf of.

This includes an individual who exercises or has the right to exercise significant influence or control over the company, such as:

- an individual who has an interest in at least 25% of the shares in the company;

- an individual who has shares with at least 25% of total voting power in the company; or

- an individual who holds the right, directly or indirectly, to appoint or remove directors who hold a majority of the voting rights at directors’ meetings.

To get an accurate quote, please fill out our contact form and provide the necessary details, including:

- Joint Venture Agreement (if you have one)

-

For locals (SG/SG PR):

- Photocopies of NRIC of all directors and shareholders reflecting the latest residential address.

-

For foreigners:

- Valid and clear passport copy of all directors and shareholders.

- Residential address proof (within the last 3 months) for all directors and shareholders. Proof can be credit card statements, bank statements, utility bills, phone bills, etc., translated into English.

-

For corporate shareholders:

- Certificate of Incorporation, M&AA/Constitution, Business Profile, or Certificate of Incumbency showing the company's shareholding structure.

- More documents may be requested until the ultimate beneficial owner is identified

It is important to be aware that DP holders are not permitted to be business owners in Singapore. Therefore, you will need to apply for a Letter of Consent (LOC) once you have established the sole proprietorship/partnership. Please keep in mind that the approval of the LOC application is at the discretion of the Ministry of Manpower (MOM). In the rare event of a rejection, you would be required to dissolve the sole proprietorship/partnership.

In order to run a company with your Dependant Pass (DP), you need to be a company director with at least 30% shareholding in an ACRA-registered business to fulfil the criteria for Letter Of Consent Application to run the company.

The process and estimated timeline are stated below:

- Incorporation- Within 1 working day (to be done by Swiftly)

- CorpPass Activation - 1-3 working days (to be done by client)

- MOM Account Activation - within 7 working days (to be done by Swiftly)

- Submit an online request to apply for an LOC - within 7 working days (to be done by Swiftly)

- LOC Application - within 4 weeks for most cases (to be done by Swiftly)

Kindly note to be eligible for a renewal of the LOC, the company will also need to hire at least one local Singaporean citizen or permanent resident who:

- Earns at least S$1,400/ month; and

- Receives CPF contributions for at least 3 consecutive months

Simply fill up the incorporation form and make payment. It’s that simple. Our proprietary technology includes reputable and secure APIs such as Myinfo and Sumsub that can automatically extract vital personal information from you and populate the form for ultra-fast submission. Once the form is submitted, Swiftly is able to generate the legal documents within seconds for your E-Signing. Once the documents are E-Signed, we will proceed to incorporate the company on ACRA. Swiftly’s Technology is the fastest, most secure in the market.

What is the biggest difference between a Pte Ltd and a Sole Proprietorship?

- Pte Ltd: It’s a separate legal entity. The company exists on its own, apart from you.

- Sole Proprietorship: You are the business — no legal separation between you and the company.

Who is liable for debts?

- Pte Ltd: Your liability is limited to the shares you hold. Your personal assets are protected.

- Sole Proprietorship: You have unlimited liability. If the business owes money, creditors can come after your personal assets.

What about taxes?

- Pte Ltd: Corporate tax rate starts at 17%, with attractive tax exemptions for startups in the first 3 years.

- Sole Proprietorship: Profits are taxed as personal income, which can go up to 22% in Singapore.

How does credibility differ?

- Pte Ltd: Generally seen as more professional and trustworthy. Investors, banks, and partners usually prefer dealing with companies.

- Sole Proprietorship: Quick to start, but less credible for bigger clients or fundraising.

Can I bring in partners or investors?

- Pte Ltd: Yes — just issue shares. Easy to onboard co-founders or investors.

- Sole Proprietorship: No. It’s tied to you personally, so you can’t bring in shareholders.

What about compliance and cost?

- Pte Ltd: Requires a corporate secretary, annual filings, and more paperwork. Costs more to maintain.

- Sole Proprietorship: Cheaper and simpler. Minimal filings. But you give up protection and long-term advantages.

Which is better for me?

- Pte Ltd: Choose Pte Ltd if you’re serious about growth, raising funds, limiting liability, and building credibility.

- Sole Proprietorship: Choose Sole Proprietorship if it’s just a side hustle, low risk, and you want something quick and low-cost.

Companies must appoint a company secretary within 6 months from the date of incorporation. This position cannot be left vacant for more than 6 months or the directors may face a penalty of up to $1,000.

A Company Secretary is responsible for the administration of the company. He/She is also required to ensure that all the directors and shareholders are informed of their statutory obligations such as the filing of annual returns.

The responsibilities of a Company Secretary can be varied depending on a company’s needs. Below are some examples:

a) Maintain and update the company’s registers and minutes books.

b) Administer, attend and prepare minutes of meetings of directors and shareholders.

c) Keep company directors aware of the deadlines for annual returns and any other filings required by ACRA.

d) Update directors and shareholders on relevant changes in corporate regulations.

Many businesses opt to outsource the functions of a Company Secretary because it is cost-effective and convenient. At Swiftly, with the proprietary technology we have invented and our our team of experts to advice on everything pertaining to Company Secretarial services, your company will be in very safe hands. There is also a wide range of complementary services, such as Free professional consultation and auto-filing reminders, just to name a few. statutory obligations under the Companies Act; engaging in Swiftly’s Company Secretarial ACRA has issued countless summons to companies that have violated or failed to comply with the services ensures compliance with regulatory requirements.

Before appointing yourself as the Company Secretary for your business, you should be aware of the requirements of a Company Secretary. According to the Companies Act of Singapore, a Company Secretary must be a resident of Singapore, such as a citizen or a permanent resident. The Company Secretary must also have the necessary experience, knowledge and qualifications for the position.

- Business Profile of Company - Provided by ACRA (Can be extracted via Myinfo Business)

- Memorandum and Articles of Association / Constitution

- Directors’ Particulars (Can be extracted via Myinfo/Sumsub)

- Shareholders’ Particulars (Can be extracted via Myinfo/Sumsub)

No it is not. Switching Company Secretaries is quick,easy and total fuss-free.

We will help you prepare all the documents and submit them to ACRA on your behalf. You do not have to do anything.

Most businesses in Singapore do not need a full-time Company Secretary, so by outsourcing the role you will be able to save costs while ensuring that your secretarial responsibilities are still being handled by experienced professionals who assist you with compliance and provide related practical solutions.

Swiftly will contact your current provider to collect all your statutory records and file the necessary notifications to ACRA on the change. Even if your current providers do not respond, we will go ahead with the procedure. The transaction will be SWIFTLY processed regardless!

A local registered address is one of the minimum requirements for opening a company in Singapore. The registered address must be a physical address in Singapore i.e a physical location and not just a Post Office Box (PO Box). All companies must ensure that their registered office is open and accessible to the public for at least three hours during ordinary business hours on each business day.

No, you can consider taking up our registered address service which allows you to use our address for incorporation. We will handle your letters, scanning and saving them within the Swiftly Portal. An email will also be sent to you to notify you whenever a letter has been received.

Our registered address service includes:

- Receipt of Mails

- Notifications of all Incoming Mails

- Opening & Scanning of Mails

- Storing scanned copies of Mails within your Swiftly Portal for viewing

Under the Home Office Scheme, homeowners are allowed to conduct small-scale businesses using their residential premises. This scheme applies to both HDB and private properties. Application for approval under the Home Office Scheme can be submitted before or after business/company incorporation with ACRA. For more information, please refer to the following guides from HDB and ACRA

A Nominee Director in Singapore is a local resident director appointed to meet the legal requirement for company incorporation. They act as a local representative for the company but do not participate in its operations or decision-making.

A Director is responsible for managing the affairs of the company and setting the company’s strategic direction. A Director is required under the Companies Act to ensure accurate and timely record keeping, prepare financial statements (if applicable) and comply with corporate filings and other disclosures. The director also has the legal duty to advance the interests of the company, act honestly and in good faith in exercising the given powers. The consequences of breaching the director’s duties can be both civil and criminal in nature. Different offences carry different levels of penalty. For common offences, a Director could be liable up to a fine of S$5,000 or even imprisonment of up to two years. Other offences can result in disqualification from being a Director for a period of 5 years.

No, the Nominee Director cannot manage or be involved in the operations of the Company.

The Nominee Director will neither be the bank signatory to the corporate account nor play an active role in the Company. The Nominee Director will only be the named Director of the Company, in order to fulfil the statutory requirements.

If you're a foreign entrepreneur, Singapore law requires at least one local director for company incorporation. A nominee director helps fulfill this requirement, allowing you to set up and run your business in Singapore.

Yes, you can terminate the Nominee Director Service anytime by providing us with the details of an alternate local resident Director.

The Nominee Director runs the risk of being taken to court should a company, or its other Directors break the law. Therefore, it is imperative that he or she monitors the activities of the company closely to ensure that it complies with any regulatory requirements. In view of such liability, Swiftly conducts a comprehensive KYC review before entering into a Nominee Dire ctor service agreement with our clients

Directors of the company are legally responsible and accountable for complying with the requirements of the Singapore Companies Act. Failure to adhere to the statutory compliance requirements is an offence and may result in fines or prosecution.

- Business Profile of Company - Provided by ACRA (Can be extracted via Myinfo Business)

- Memorandum and Articles of Association / Constitution

- Directors’ Particulars (Can be extracted via Myinfo/Sumsub)

- Shareholders’ Particulars (Can be extracted via Myinfo/Sumsub)

Yes, a nominee director can be the sole director for the company. However, Swiftly does not currently provide nominee director services for companies that do not have another foreigner/local director.

Singapore has its own Accounting standards called Singapore Financial Reporting Standards (SFRS). It’s similar to IFRS and it’s accrual-based accounting. This means transactions are recognised when they take place and not when the money is paid. Outsourced accounting services in Singapore must comply with SFRS requirements.

We will assign an experienced accountant to you. Your accountant will analyse your financial records. He or she will track filing deadlines, propose possible tax exemptions and generate reports so you get a clear view of your actual tax status.

This depends on your preference and the company’s needs. Company accounts can be done on a monthly, quarterly or yearly basis. If the company is GST Registered, the Company accounts would have to be done minimally on a quarterly basis.

For you to produce accurate accounting statements, you will have to be kept updated with the latest changes in the Singapore accounting laws. Should you have the relevant skillset and time required to prepare the accounts according to the government's standards, you are able to do so. However, it is far better to let the professionals handle accounting and auditing tasks. This will free you to concentrate on the core functions of your business.

Professional accountants at Swiftly make sure that they are updated with the changes in requirements. This ensures that the prepared accounts are up to the required standards.Swiftly can also advice you on tax issues related to your business.

You will have to choose a trustworthy Singapore accounting service provider. And no one better than Swiftly! This helps you save both money and time, of which would have been spent selecting and training accounting professionals for your company.

Professionals at Swiftly submit accurate and timely reports for you. We use the latest accounting software to process your data securely. With our experience, handling your compliance requirements never gets easier.

Yes, it is possible to transfer money out of Singapore. Singapore has signed double-taxation treaties with more than 50 trading partners. These help businesses and individuals in avoiding double taxation on their cross-border income.

The destination country may apply tax when your money arrives in its jurisdiction. Check with a tax consultant to know the latest requirements.

All Singapore companies are required by law to maintain proper accounting records. These records are essential for the preparation of financial statements and tax filings, and failure to comply with the regulations can result in penalties and legal consequences.

Our company specializes in providing accounting/tax services to businesses of all sizes. We have a team of experienced professionals who can help you keep your financial records in order and ensure compliance with the relevant regulations. With our expertise, you can focus on running your business and leave the mundane accounting/tax work to us.

To schedule a consultation or learn more about our services and fees, select your preferred time slot here. We would be more than happy to discuss your accounting/tax needs and recommend the ideal solution for your business.

All companies must file Estimated Chargeable Income (ECI) with the Inland Revenue Authority of Singapore (IRAS) within 3 months from the end of their financial year. This estimate is used to determine the company's tax liabilities for the following year.

To schedule a consultation or learn more about our services and fees, select your preferred time slot here. We would be more than happy to discuss your accounting/tax needs and recommend the ideal solution for your business.

All Singapore companies are required by law to hold an AGM (Annual General Meeting) within 6 months of the company's financial year-end. Failure to comply with this requirement can result in penalties and legal consequences.

Company Secretarial services from Swiftly includes the preparation of minutes of AGM.

We will send over the AGM documents together with the financial statement once it’s done.

If you did not engage our accounting service, kindly upload your Financial Statements via your swiftly portal and we will send the AGM documents for your signing.

All Singapore companies are required by law to file the Annual Returns within 7 months of the company's financial year-end.

Failure to comply will incur the following late filing penalties:

- Penalty for the late holding of AGM – SGD300

- Penalty for the late filing of Annual Returns – Starts from SGD300

All Singapore companies have the option to apply for a one-time extension of 60 days if they require additional time to hold the AGM or file the annual returns.

You can make the request to file for an AGM / AR extension via the Swiftly portal.

- Bank Statements with transaction details

- Sales Invoices (including unpaid) or Sales Report (with details)

- Supplier Invoices (including unpaid) or Expenses Report (with details)

- Expenses & Receipts

- Cheque Stubs & Cash Deposit bank-In slips

- Payment & Petty Cash Vouchers

- Salary Vouchers and/or Payroll Summary (including casual labour & part-timers)

- CPF Statement / Foreign Worker Levy (If applicable)

- Hire Purchase Agreement / Tenancy Agreement (If Applicable)

- Subcontractor Listing / Commission Paid

The Government and Services Tax or GST is a consumption tax that is level in nearly all of the goods and services in Singapore. This is similar to the Value Added Tax or VAT in many countries. More information can be found in this link

The company is mandated to register for GST if its annual turnover surpasses S$1 million during the previous year or if the company’s expected annual turnover in the coming year surpasses S$1 million.

You need to prepare financial statements simply because:

1. It is required by the law to do so. The Companies Act states in S201 that the directors of the company need to prepare the accounts that complies with the “Accounting Standards”. Accounting Standards is interpreted in the Act as “made or formulated by the Accounting Standards Council under Part III of the Accounting Standards Act 2007”. Therefore, the Accounts mentioned in the Act means Accounts prepared in accordance to the Financial Reporting Standards of Singapore, that is, the Financial Statements.

2. IRAS requires you to prepare financial statements and tax computation for submission of corporate tax every year. In recent years, you do not need to submit your financial statements to IRAS if your Company is eligible to file for Form C-S filing. However IRAS has explicitly mentioned that you will still be required to continue to maintain your accounting records and tax computation even if you need not submit them together with the Form C-S.

3. If your company is not exempt, or is exempt but insolvent, you will need to submit your financial statements to ACRA during the Annual Return filing period.

4. Financial statements are in essence, a report card of the financial performance of the company and the information presented will be extremely valuable to the owners of the Company, as well as directors of the company, when assessing the future plans of the Company.

5. Whenever you intend to sell shares of your company to another investor, stamp duties need to be paid and a part of the stamp duty computation requires the use of financial statements to derive the net asset value of the Company.

6. If you have taken up business or property loan, a copy of your financial statements may be required in your refinancing procedures.

Preparation of Financial Statement includes:

1. Reviewing the accounts provided to assess the necessary adjustments needed

2. Reviewing and classification of accounts into respective classes of accounts

3. Notes to accounts preparation - required for financial report

4. FS disclosure - required for financial report

5. Preparation of full final financial report

Even though you are not required to file the financial statements, you will still be required to prepare it.

Under sections 201(2) and 201(5) of the Companies Act (the "Act"), directors are responsible to present and lay before the company, at its annual general meeting, financial statements that:

- comply with Accounting Standards1 issued by the Accounting Standards Council; and

- give a true and fair view of the financial position and performance of the company.

In addition, directors of a company incorporated in Singapore are responsible to maintain a system of internal accounting controls and keep proper accounting and other records that will enable the preparation of true and fair financial statements under sections 199(2A) and 199(1) of the Act, respectively.

Preparing a company’s financial statement is a complex process that only qualified accountants should undertake. If you are not familiar with the accounting and financial reporting standards in Singapore, it is best to engage the services of an accountant, like Swiftly, to ensure compliance with ACRA & IRAS requirements.

Singapore has a single-tier territorial-based flat-rate corporate income tax system.

Corporate Income Tax is assessed on a preceding year basis in Singapore. Singapore’s Corporate Income Tax is at a flat rate of 17% of its chargeable income.

Chargeable income refers to your company's taxable income (after deducting tax-allowable expenses) for a Year of Assessment (YA).

Learn more about taxable and non-taxable income and business expense.

The Estimated Chargeable Income or ECI is the company’s estimated amount of taxable income for an accounting period. The amount should exclude tax allowable expenses incurred during the Year of Assessment (YA).

The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies’ tax bills.

The tax exemptions for qualifying companies for their first 3 consecutive YAs are as follows:

- 75% exemption on the first $100,000 of normal chargeable income*; and

- A further 50% exemption on the next $100,000 of normal chargeable income*.

* Normal chargeable income refers to income to be taxed at the prevailing Corporate Income Tax rate of 17%.

Your company is eligible for the tax exemption scheme for new companies for its first 3 consecutive YAs if it meets all the qualifying conditions.

Electronic filing of Form C-S/C is compulsory for all companies.

Corporate tax is reported based on financial statements of the preceding financial year.

The filing deadline for corporate tax return (Form C-S/C) is on the 30th November of every year.

Example: Corporate Tax Return for Year of Assessment (YA) 2021 should be completed based on financial statement for the year ended 2020. The deadline for filing of the Corporate Tax Return (Form C-S/C) for the Year of Assessment (YA) 2021 is 30 Nov 2021.

There are mandatory requirements to complete two corporate tax filings to the IRAS annually.

They are the submission of Estimated Chargeable Income (ECI) and Corporate Tax Return (Form C/C-S).

For ECI submission, it should be submitted to the IRAS within three months of the Company's financial year end.

For Form C/C-S submission, it should be completed by 30th November of the year.

Waiver of ECI and/or Form C/C-S submission can be applicable if qualifying conditions are met.

XBRL is a standardised format of financial reporting for almost all businesses in Singapore. Depending on your company’s revenue and assets, you can submit your financial reports in Simplified XBRL format instead of the Full XBRL format.

The XBRL is the international format for financial reporting and the filing must be completed on ACRA’s portal BizFinx.

All companies incorporated in Singapore which are either limited or unlimited by shares (except exempted companies) are required to file their full set of financial statements in XBRL format according to the recent guidelines released by ACRA (Accounting and Corporate Regulatory Authority) Singapore June 2013.

The financial year end (FYE) of Singapore is the end of the fiscal accounting period of a company which is usually up to 12 months.

Once your company financial year ends, you are legally required to:

- Prepare and submit your accounts.

- File your ECI (Estimated Chargeable Income) – Within 3 months from the financial year end.

- Hold your AGM (Annual General Meeting) – Within 6 months from the financial year end.

- File your AR (Annual Returns) – Within 7 months from the financial year end.

- File your Corporate Income Tax Return (Form C-S/C) – by 30th November of the subsequent year.

1. Preparation of Management Accounts

a) Trial Balance

b) Balance Sheet

c) Profit & Loss

d) Detailed General Ledger Listing

2. Filing of Estimated Chargeable Income (ECI)

3. Preparation of Tax Computation

4. Preparation of Financial Statements in accordance to the Singapore Financial Reporting Standards

5. Annual General Meeting (AGM)

6. Filing of Annual Return with ACRA

7. Filing of Annual Tax Return with IRAS

The company is considered as dormant as long as the company meets all the criteria below:

a) Dormant company according to IRAS

A company that does not have any revenue or income during a given financial period is considered Dormant by IRAS even though it may have booked or incurred expenses.

b) Dormant company according to ACRA

ACRA defines a company as dormant during a period in which no accounting transaction occurs.

Transactions that will not affect the dormant status of the company:

- The appointment of a secretary of a company;

- The appointment of an auditor;

- The maintenance of a registered office;

- The keeping of registers and books;

- The payment of fees to the Registrar or an amount of any fine or default penalty paid to ACRA; and

- The taking of shares in the company by a subscriber to the constitution in pursuance of an undertaking in the constitution.

In addition to the points we have listed above as long as the payment or receipt is not exceeding the nominal sum of S$5,000, the company can be classified as dormant.

Previously, a company is exempted from having its accounts audited if it is an exempt private company with annual revenue of $5 million or less. This approach is being replaced by a new small company concept which will determine exemption from statutory audit. Notably, a company no longer needs to be an exempt private company to be exempted from audit.

A company qualifies as a small company if:

(a) it is a private company in the financial year in question; and

(b) it meets at least 2 of 3 following criteria for immediate past two consecutive financial years:

1. total annual revenue ≤ $10m;

2. total assets ≤ $10m;

3. no. of employees ≤ 50.

For a company which is part of a group:

(a) the company must qualify as a small company; and

For a company which is part of a group:

(b) entire group must be a “small group”

to qualify to the audit exemption.

For a group to be a small group, it must meet at least 2 of the 3 quantitative criteria on a consolidated basis for the immediate past two consecutive financial years.

Where a company has qualified as a small company, it continues to be a small company for subsequent financial years until it is disqualified.

A small company is disqualified if:

(a) it ceases to be a private company at any time during a financial year; or

(b) it does not meet at least 2 of the 3 the quantitative criteria for the immediate past two consecutive financial years.

Where a group has qualified as a small group, it continues to be a small group for subsequent financial years until it does not meet at least 2 of the 3 the quantitative criteria for the immediate past two consecutive financial years.

Our team had done extensive market research, assessing time cost & sustainability and have decided that charging based on volume of transactions is the fairest. In comparison, some of our competitor’s calculation methods are based on Revenue and Profit, which we find really unfair! You should not be paying more just because you’re more profitable and presumed to be doing better due to a high revenue. We are sure there’s no better and more transparent way of assessing complexity through transactional volume.

You may use the Company’s bank statements as your reference. With every in and outs counted as 1 transaction. For example, if you have 10 incoming transactions and 10 outgoing transactions, you have a total of 20 transactions. Doesn't get any simpler!

- The company has not commenced business since incorporation or has ceased trading

- The company has no outstanding debts owed to Inland Revenue Authority of Singapore (IRAS), Central Provident Fund (CPF) Board and any other government agency.

- There are no outstanding charges in the charge register.

- The company is not involved in any legal proceedings (within or outside Singapore).

- The company is not subject to any ongoing or pending regulatory action or disciplinary proceeding.

- The company has no existing assets and liabilities as at the date of application and no contingent asset and liabilities that may arise in the future.

- All/majority of the director(s) authorise you, as the applicant, to submit the online application for striking off on behalf of the company.

For companies that have not commenced business, strike-off can be applied immediately.

1. Income Tax Returns (Form C-S/ C) are submitted up to the date of cessation of business. If the company is filing Form C, the financial statements and tax computation must also be submitted.

2. If the date of cessation of business falls in an advance Year of Assessment (YA) for which the e-Filing service is not available yet, the company can Apply for Waiver to Submit Tax Return (Dormant Company) and e-File the advance YA return;

3. All outstanding tax matters* have been settled with IRAS (e.g. answered all queries raised by IRAS, ensured all assessments are finalised and paid); and

4. GST application has been cancelled and there are no outstanding GST matters.

Swiftly employs cutting-edge technology to generate legal documents swiftly and accurately. Unlike conventional providers that rely on manual processes, our platform integrates smart software to automate the preparation of legal documents. This accelerates the process and minimizes the margin for human error.

The key advantages of Swiftly lie in its cost-effectiveness and precision. By eliminating the need for manual intervention in the document creation process, we significantly reduce operational costs, allowing us to offer our services at more competitive rates. Additionally, the technology we use ensures a higher degree of accuracy in the legal documents we prepare, mitigating the potential for errors that might arise through manual methods.

Swiftly's technology is designed to standardize and automate the creation of legal documents. This approach ensures a consistent and error-free output, as opposed to manual preparation subject to human processes' limitations and variability. Our system incorporates the latest legal standards and adapts to specific requirements, resulting in precise and reliable documents.

Swiftly covers a wide array of legal documents, including but not limited to incorporation documents, director’s resolutions, and more. The platform's technology is adaptable and can cater to various legal document needs in the corporate realm.

Traditional service providers often have higher costs due to the labor-intensive nature of manual document preparation. Swiftly, by virtue of its technology-driven approach, minimizes these labor costs, allowing us to offer our services at a more competitive rate without compromising on quality or accuracy.

Swiftly operates on a subscription-based model, providing a convenient and hassle-free approach to payments. Unlike many competitors who often rely on manual payment collection processes, our subscription model ensures automated, timely payments. This not only eases the administrative burden for clients but also guarantees that essential filings and document preparations are consistently met without interruption, reducing the risk of non-compliance penalties due to delayed payments.

Failure to comply with regulatory requirements due to delayed or missed filings can lead to significant penalties for businesses. Traditional service providers, relying on manual payment collection methods, are prone to processing delays or missed payments, resulting in non-compliance issues and subsequent penalties for their clients. Swiftly's automated subscription model ensures prompt payments, enabling timely filing and document preparation, thereby reducing the risk of non-compliance penalties.

Various legal and compliance filings, such as annual reports, business incorporation, and tax documents, can be affected by delayed payments and subsequent non-compliance. Swiftly's automated payment system mitigates this risk, ensuring that these crucial filings are executed promptly and accurately, preventing any potential penalties or legal complications for our clients.

Foreigners looking to register a Limited Liability Partnership (LLP) in Singapore must appoint a locally resident manager. This includes Singapore citizens, permanent residents, or individuals holding an EntrePass or Employment Pass.

A Limited Liability Partnership (LLP) is a separate legal entity from its partners. It can:

- Sue and be sued under its own name

- Acquire and hold property under its own name

- Use a common seal under its own name

- Perform other legal acts as allowed for corporate bodies

For income tax purposes, a LLP is treated as a partnership, not as a separate legal entity. This means the LLP is not taxed at the entity level. Instead, each partner is taxed on their share of the LLP's income.

Where the partner is an individual, the partner's share of income from the LLP will be taxed based on the individual income tax rate. Where the partner is a company, the partner's share of income from the LLP will be taxed at the corporate income tax rate.

There must be a minimum of two partners. However, there is no cap on the maximum number of partners.

Partners in an LLP can be either individuals or companies.

-

Annual Declaration

The manager of every LLP is responsible for lodging an annual declaration stating whether the LLP is solvent or insolvent.

The first annual declaration must be lodged within 15 months from the date of registration of the LLP. Subsequent declarations must be lodged once every calendar year and not more than 15 months after the lodgement of the last declaration. -

Annual Income Tax Return (Form P)

All partners of a LLP are required to file an annual Income Tax Report (Form P) to show all income earned and business expenses deducted by the partnership during the year.

E-filing of Form P is available from 1 Feb and due on 18 Apr each year.

We assist with the setting up of a Limited Liability Partnership (LLP) at a fee of SGD$800 with locals and SGD$1000 with foreigners. Contact us today to get started!

A Work Permit (WP) is a type of work pass that allows foreign workers to work in Singapore, typically for semi-skilled workers in specific sectors like construction, manufacturing, and services.

Foreign workers from approved source countries and specific industries (e.g. construction, manufacturing, services, and domestic work) are eligible. The eligibility criteria may vary by industry.

The duration of a Work Permit varies depending on the sector and worker’s employment, usually ranging from 1 to 2 years. It can be renewed if the worker continues to meet the necessary conditions.

Work Permit holders are generally not eligible to bring their family members to Singapore under the Dependant’s Pass or Long Term Visit Pass scheme.

Unlike other passes such as the Employment Pass or S Pass, there is no minimum salary requirement for Work Permit holders. However, employers must adhere to industry-specific wage guidelines.

There is a quota for Work Permit holders in Singapore, which is regulated by the Dependency Ratio Ceiling (DRC). The DRC sets the maximum proportion of foreign workers that a company can employ based on the total workforce. The quota varies by industry.

Employers can apply for a Work Permit online through the Ministry of Manpower (MOM) website. The process includes submitting the necessary documents and paying the application fees. Alternatively, we offer professional assistance to streamline the process. Contact us today to learn more about how we can support your needs!

The S Pass is a work visa for mid-level skilled workers who wish to work in Singapore. It is aimed at professionals such as technicians, specialists, and junior executives.

Eligibility for the S Pass is based on a combination of criteria, including a minimum monthly salary of SGD 3,150 (higher for older or more experienced candidates), relevant work experience, and academic qualifications (such as a diploma or degree).

The S Pass is typically valid for up to 2 years, and it can be renewed as long as the pass holder continues to meet eligibility criteria and has a valid job offer.

S Pass holders earning at least SGD 6,000 per month are eligible to apply for a Dependant’s Pass for their spouse and children. Those earning SGD 12,000 or more can apply for a Long Term Visit Pass for other dependents, such as parents.

Employers can apply for a S Pass online through the Ministry of Manpower (MOM) website. The process includes submitting the necessary documents and paying the application fees. Alternatively, we offer professional assistance to streamline the process. Contact us today to learn more about how we can support your needs!

Yes, there is a Dependency Ratio Ceiling (DRC) that limits the number of S Pass holders a company can hire. The current quota is 10% to 18% of the total workforce, depending on the industry.

The minimum qualifying salary for an S Pass is SGD$3,150 per month. For more experienced candidates, the required salary may be higher.

The Employment Pass (EP) is a work visa for foreign professionals, managers, and executives who wish to work in Singapore. It is typically for individuals in managerial, executive, or specialized roles.

To qualify for an EP, applicants must have a job offer in Singapore, earn a minimum monthly salary of SGD$5,000 (higher for older and more experienced candidates), and possess acceptable qualifications, such as a good university degree or professional credentials.

The EP is typically issued for 1 to 2 years and can be renewed for up to 3 years, provided the pass holder continues to meet eligibility criteria and has a valid employment contract.

Yes, EP holders earning at least SGD$6,000 per month can apply for a Dependant’s Pass for their spouse and children. Those earning SGD$12,000 or more can also apply for a Long Term Visit Pass for parents and other dependants.

No, there is no quota or limit on the number of Employment Pass holders a company can hire, unlike the S Pass or Work Permit.

Yes, EP holders can start and run a business in Singapore. They may need to apply for a Letter of Consent (LOC) or an additional work pass if they want to hold a secondary directorship or employment.

Employers can apply for an Employment Pass online through the Ministry of Manpower (MOM) website. The process includes submitting the necessary documents and paying the application fees. Alternatively, we offer professional assistance to streamline the process. Contact us today to learn more about how we can support your needs!